DJO Global Announces Financial Results for Fourth Quarter and Fiscal Year End 2012

SAN DIEGO, CA, February 13, 2013 – DJO Global, Inc. (“DJO” or the “Company”), a leading global provider of medical device solutions for musculoskeletal health, vascular health and pain management, today announced financial results for its public reporting subsidiary, DJO Finance LLC (“DJOFL”), for the fourth quarter and fiscal year ended December 31, 2012.

Fourth Quarter Results

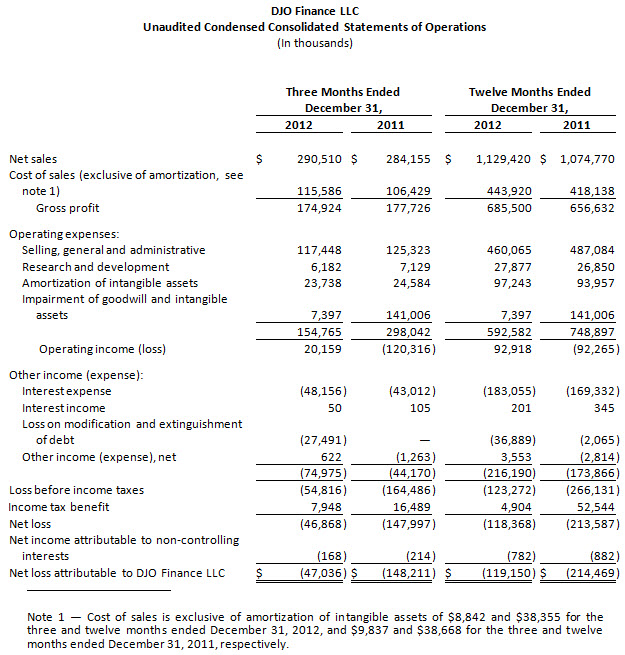

DJOFL achieved record net sales for the fourth quarter of 2012 of $290.5 million, reflecting growth of 2.2 percent compared to net sales of $284.2 million for the fourth quarter of 2011. Net sales for the fourth quarter of 2012 were unfavorably impacted by $1.5 million related to changes in foreign currency exchange rates compared to the rates in effect in the fourth quarter of 2011. Excluding the impact of changes in foreign currency exchange rates from rates in effect in the prior year period (“constant currency”), net sales for the fourth quarter of 2012 increased 2.8 percent compared to net sales for the fourth quarter of 2011.

For the fourth quarter of 2012, DJOFL reported a net loss attributable to DJOFL of $47.0 million, compared to a net loss of $148.2 million for the fourth quarter of 2011. As detailed in the attached financial tables, the results for the current and prior year fourth quarter periods were impacted by significant non-cash items, non-recurring items and other adjustments, although such adjustments were significantly lower in the current year period than in the prior year period.

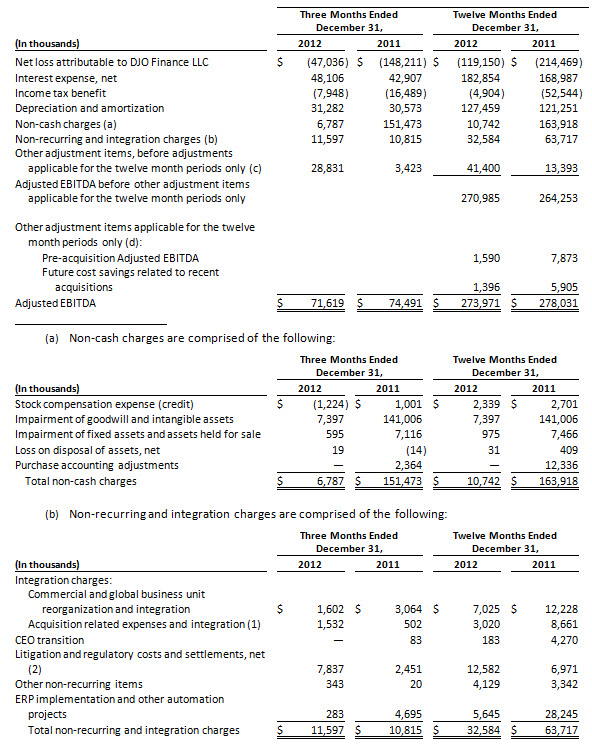

The Company defines Adjusted EBITDA as net (loss) income attributable to DJOFL plus interest expense, net, income tax provision (benefit), and depreciation and amortization, further adjusted for certain non-cash items, non-recurring items and other adjustment items as permitted in calculating covenant compliance under the Company’s amended senior secured credit facility and the indentures governing its 8.75% second priority senior secured notes, its 9.875% and 7.75% senior notes and its 9.75% senior subordinated notes. Reconciliation between net loss and Adjusted EBITDA is included in the attached financial tables.

Adjusted EBITDA for the fourth quarter of 2012 was $71.6 million, or 24.7 percent of net sales, reflecting a decrease of 3.9 percent compared with Adjusted EBITDA of $74.5 million, or 26.2 percent of net sales, for the fourth quarter of 2011. Adjusted EBITDA for the fourth quarter of 2012 was unfavorably impacted by $0.4 million related to changes in foreign currency exchange rates compared to the rates in effect in the fourth quarter of 2011. Adjusted EBITDA for the fourth quarter of 2011 included a $4.2 million benefit related to an adjustment to reduce deferred gross profit from intercompany sales of inventory. In constant currency and excluding the $4.2 million adjustment recorded in the fourth quarter of 2011, Adjusted EBITDA for the current quarter was $72.0 million, reflecting an increase of 2.4 percent compared with Adjusted EBITDA of $70.3 million for the fourth quarter of 2011.

Year-to-Date Results

DJOFL achieved record net sales of $1,129.4 million for the year ended December 31, 2012, reflecting growth of 5.1% compared to net sales of $1,074.8 million for the year ended December 31, 2011. Net sales for 2012 were unfavorably impacted by changes in foreign currency exchange rates aggregating $15.3 million compared to the rates in effect in 2011. In constant currency, net sales for 2012 increased by 6.5% compared to net sales for 2011.

DJOFL’s net sales for 2012 included net sales from businesses acquired in 2011. On a pro forma basis, as if the acquisitions of Circle City Medical, acquired in February 2011, and Dr. Comfort, acquired in April 2011, had both closed on January 1, 2011, net sales would have reflected growth of 4.5% on the basis of constant currency over pro forma net sales of $1,095.4 million for 2011.

For the year ended December 31, 2012, DJOFL reported a net loss attributable to DJOFL of $119.2 million, compared to a net loss attributable to DJOFL of $214.5 million for the year ended December 31, 2011. As detailed in the attached financial tables, the results for the years ended December 31, 2012 and 2011 were impacted by significant non-cash items, non-recurring items and other adjustments. For the year ended December 31, 2012, DJOFL achieved operating income of $92.9 million, reflecting significant improvement compared to an operating loss of $92.3 million for the year ended December 31, 2011.

Adjusted EBITDA for the year ended December 31, 2012 was $271.0 million, or 24.0% of net sales, reflecting an increase of 2.5% compared with Adjusted EBITDA of $264.3 million, or 24.6% of net sales, for the year ended December 31, 2011. Adjusted EBITDA for 2012 was unfavorably impacted by $3.2 million related to changes in foreign currency exchange rates compared to the rates in effect in 2011. In constant currency and pro forma for the acquisitions discussed above and excluding the $4.2 million adjustment recorded in the fourth quarter of 2011, Adjusted EBITDA for the year ended December 31, 2012 was $274.2 million, reflecting growth of 2.4% compared with pro forma Adjusted EBITDA of $267.9 million for the year ended December 31, 2011.

Including $1.6 million of preacquisition Adjusted EBITDA and $1.4 million of anticipated future cost savings related to recently acquired businesses, Adjusted EBITDA was $274.0 million, or 24.3 percent of net sales for the year ended December 31, 2012.

“We are pleased to end 2012 with full year constant currency growth in net sales of 4.5% compared to pro forma net sales for 2011. Our successful new product launches and improving commercial execution continue to drive strong momentum across most of our businesses and provide a solid foundation for incremental growth in 2013,” said Mike Mogul, DJO’s president and chief executive officer. “I want to especially congratulate our Bracing and Vascular, Surgical Implant and International teams, for delivering strong organic growth of 8.2%, 12.4% and 5.7%, respectively, in 2012. Although we continue to face market challenges in our Recovery Sciences business unit, with sales declining 2.3% in 2012 compared to 2011, the strength of the sales results from our other businesses compensated for those headwinds in 2012. As expected, our fourth quarter growth rates were impacted by the anniversary of the October 2011 launch of Exos and the first full quarter impact of the recent non-coverage decision by Medicare for TENS used to treat chronic low back pain (“CLBP”). We were very pleased to see average daily sales in the fourth quarter accelerate from average daily sales in the third quarter for all business segments, including Recovery Sciences.

“We were very excited to complete the acquisition of Exos right at year end and we welcome the Exos team to the DJO Global family. Because we were already the exclusive distribution partner for Exos, the merger will not impact our reported net sales, but is expected to increase our operating margins and operating income from the sale of Exos products, and importantly, permit us to participate more comprehensively in planning and executing many exciting new product development opportunities incorporating the Exos technology.

“We are also pleased to report strong constant currency Adjusted EBITDA results in the fourth quarter at 24.7% of net sales, the highest quarterly margin in 2012, in spite of our continuing investments in new product development and launch activities and to expand and strengthen our commercial organization.

“Having just finished a highly successful global sales meeting, we continue to be very optimistic about incremental opportunities to add value to our customers and to further accelerate DJO’s revenue growth. While it’s great that we are achieving our short-term revenue growth targets of mid-single digits, we remain very keenly focused on continuing to enhance our customers’ experience by developing and launching innovative new products and by striving for continuous improvement in our commercial execution.

“We have a very exciting slate of new products for 2013 that we will begin to launch late in the first quarter. We expect these new products and other ongoing commercial initiatives to drive incremental top line growth beginning in the second quarter of 2013, and we are targeting total company full year revenue growth rates of at least 5% for the full 2013 year. As it relates specifically to the first quarter of 2013, we expect total company revenue growth rates to continue to be somewhat muted by the impact of the Medicare CLBP decision and the anniversary dates of certain new products launched in 2012.

“For the full 2013 year, we expect to absorb the impact of both the Medicare CLBP decision and the new Medical Device Excise Tax (“MDET”) and still deliver growth in Adjusted EBITDA that is at least as high as our revenue growth. For the first quarter, however, we expect Adjusted EBITDA and Adjusted EBITDA margins to contract modestly from the prior year amounts, due to the impact of the MDET and the Medicare CLBP decision, along with increased operating expense investments related to upcoming product launches planned for the meeting of the American Academy of Orthopedic Surgeons in March.”

Sales by Business Segment

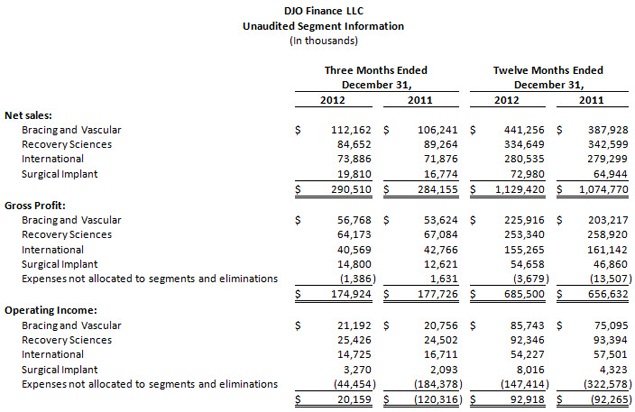

Net sales for DJO’s Bracing and Vascular segment were $112.2 million in the fourth quarter of 2012, reflecting growth of 5.6%, compared to the fourth quarter of 2011, driven by strong contribution from the sales of new products and improving sales execution. For the full year of 2012, net sales for the Bracing and Vascular segment increased 8.2% on a pro forma basis over the full year of 2011.

Net sales for the Recovery Sciences segment contracted by 5.2% compared to the fourth quarter of 2011 to $84.7 million, primarily reflecting the effects of the Medicare CLBP decision on the EMPI business unit and slow market conditions for capital equipment sold by our Chattanooga business. For the full year of 2012, net sales for the Recovery Sciences segment contracted 2.3% from net sales for the full year of 2011.

Fourth quarter net sales within the International segment were $73.9 million, reflecting an increase of 2.8% from the prior year period including the impact of $1.5 million of unfavorable changes in foreign currency exchange rates from rates in effect in the fourth quarter of 2011. In constant currency, growth in net sales from the prior year fourth quarter was 4.9% for the International segment. For the full year of 2012, net sales for the International segment increased 5.7% on a constant currency basis over pro forma sales for the full year of 2011.

Net sales for the Surgical Implant segment were $19.8 million in the fourth quarter, reflecting an increase of 18.1% over net sales in the fourth quarter of 2011, driven by strong sales of the Company’s shoulder products and other new products and strong sales execution. For the full year of 2012, net sales for the Surgical Implant segment increased 12.4% over 2011.

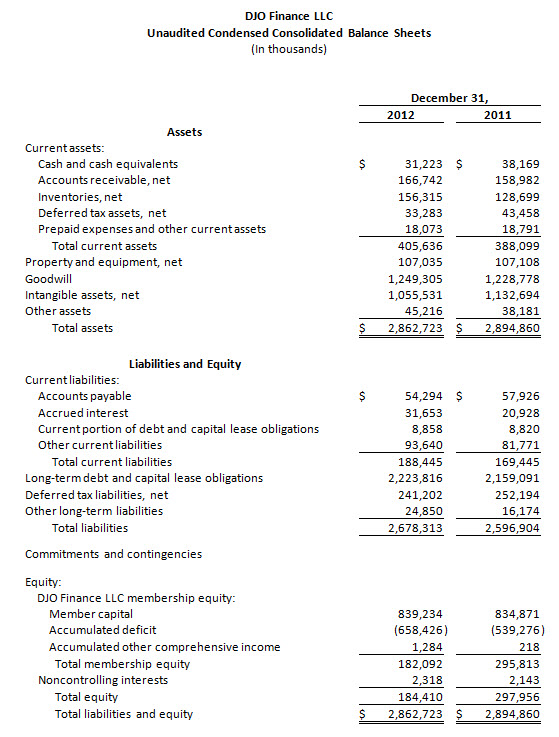

As of December 31, 2012, the Company had cash balances of $31.2 million and available liquidity of $97.0 million under its revolving line of credit. As previously announced, during the third quarter of 2012, the Company commenced a comprehensive refinancing which closed early in the fourth quarter. The refinancing included the issuance of $100.0 million tack‐on 8.75% second priority senior secured notes due 2018, as well as $440.0 million of new 9.875% senior unsecured notes due 2018. The proceeds of the new issues were used: (1) to repay all amounts outstanding on DJOFL’s revolving line of credit at the closing date, (2) to repay a portion of DJOFL’s $465 million of 10.875% senior unsecured notes which were tendered to DJOFL prior to the closing date and (3) to pay premiums and expenses incurred in connection with the refinancing. DJOFL redeemed all remaining outstanding 10.875% senior unsecured notes on November 15, 2012. On December 28, 2012, DJOFL increased the term loans outstanding under its amended Senior Secured Credit Facility by $25 million. The Company used the proceeds of this incremental term loan and cash on hand to finance the completion, on December 28, 2012, of the Exos acquisition previously announced.

For the year ended December 31, 2012, DJOFL generated cash flow from operating activities of $44.6 million, after cash interest payments of $162.6 million. For the year ended December 31, 2011, DJOFL generated cash flow from operating activities of $23.6 million, after cash interest payments of $151.2 million. Cash flow from operations before cash interest of $207.2 million for 2012 reflected an increase of 18.5% over cash flow from operations before cash interest of $174.8 million for 2012.

Conference Call Information

DJO has scheduled a conference call to discuss this announcement beginning at 1:00 pm, Eastern Time today, February 13, 2013. Individuals interested in listening to the conference call may do so by dialing (866) 394-8509 (International callers please use (706) 643-6833), using the reservation code 22322226. A telephone replay will be available for 48 hours following the conclusion of the call by dialing (855) 859-2056 and using the above reservation code. The live conference call and replay will be available via the Internet at www.DJOglobal.com.

About DJO Global

DJO Global is a leading global developer, manufacturer and distributor of high-quality medical devices that provide solutions for musculoskeletal health, vascular health and pain management. The Company’s products address the continuum of patient care from injury prevention to rehabilitation after surgery, injury or from degenerative disease, enabling people to regain or maintain their natural motion. Its products are used by orthopedic specialists, spine surgeons, primary care physicians, pain management specialists, physical therapists, podiatrists, chiropractors, athletic trainers and other healthcare professionals. In addition, many of the Company’s medical devices and related accessories are used by athletes and patients for injury prevention and at-home physical therapy treatment. The Company’s product lines include rigid and soft orthopedic bracing, hot and cold therapy, bone growth stimulators, vascular therapy systems and compression garments, therapeutic shoes and inserts, electrical stimulators used for pain management and physical therapy products. The Company’s surgical division offers a comprehensive suite of reconstructive joint products for the hip, knee and shoulder. DJO Global’s products are marketed under a portfolio of brands including Aircast®, Chattanooga, CMF™, Compex®, DonJoy®, Empi®, ProCare®, DJO® Surgical, Dr. Comfort® and ExosTM, For additional information on the Company, please visit www.DJOglobal.com.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements relate to, among other things, the Company’s expectations for its growth in revenue and Adjusted EBITDA and its opportunities to improve commercial execution and to develop new products and services. The words “believe,” “will,” “should,” “expect,” “intend,” “estimate” and “anticipate,” variations of such words and similar expressions identify forward-looking statements, but their absence does not mean that a statement is not a forward-looking statement. These forward-looking statements are based on the Company’s current expectations and are subject to a number of risks, uncertainties and assumptions, many of which are beyond the Company’s ability to control or predict. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The important factors that could cause actual operating results to differ significantly from those expressed or implied by such forward-looking statements include, but are not limited to: the successful execution of the Company’s business strategies relative to its Bracing and Vascular, Recovery Sciences, International and Surgical Implant segments; the continued growth of the markets the Company addresses and any impact on these markets from changes in global economic conditions; the successful execution of the Company’s sales and acquisition strategies; the impact of potential reductions in reimbursement levels and coverage by Medicare and other governmental and commercial payors; the Company’s highly leveraged financial position; the impact on the Company and its customers from changes in global credit markets; the Company’s ability to successfully develop, license or acquire, and timely introduce and market new products or product enhancements; risks relating to the Company’s international operations; resources needed and risks involved in complying with government regulations and in developing and protecting intellectual property; the availability and sufficiency of insurance coverage for pending and future product liability claims, including multiple lawsuits related to the Company’s cold therapy products and its discontinued pain pump business; and the effects of healthcare reform, Medicare competitive bidding, managed care and buying groups on the prices of the Company’s products. These and other risk factors related to DJO are detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, filed with the Securities and Exchange Commission (“SEC”) on February 21, 2012, and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, filed with the SEC on May 1, 2012. Many of the factors that will determine the outcome of the subject matter of this press release are beyond the Company’s ability to control or predict.

DJO Finance LLC

Adjusted EBITDA

For the Three and Twelve Months Ended December 31, 2012 and December 31, 2011

(unaudited)

Our Amended Senior Secured Credit Facility, consisting of a $476.5 million term loan, a $385.5 million term loan and a $100.0 million revolving credit facility, under which $3.0 million was outstanding as of December 31, 2012, and the Indentures governing our $330.0 million of 8.75% second priority senior secured notes, $440.0 million of 9.875% senior notes, $300.0 million of 7.75% senior notes, and $300.0 million of 9.75% senior subordinated notes represent significant components of our capital structure. Under our Amended Senior Secured Credit Facility, we are required to maintain specified first lien net leverage ratios, which become more restrictive over time, and which are determined based on our Adjusted EBITDA. If we fail to comply with the first lien net leverage ratio under our Amended Senior Secured Credit Facility, we would be in default. Upon the occurrence of an event of default under the Amended Senior Secured Credit Facility, the lenders could elect to declare all amounts outstanding under the Amended Senior Secured Credit Facility to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders under the Amended Senior Secured Credit Facility could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under the Amended Senior Secured Credit Facility. Any acceleration under the Amended Senior Secured Credit Facility would also result in a default under the Indentures governing the notes, which could lead to the note holders electing to declare the principal, premium, if any, and interest on the then outstanding notes immediately due and payable. In addition, under the Indentures governing the notes, our ability to engage in activities such as incurring additional indebtedness, making investments, refinancing subordinated indebtedness, paying dividends and entering into certain merger transactions is governed, in part, by our ability to satisfy tests based on Adjusted EBITDA. Our ability to meet the covenants specified above will depend on future events, many of which are beyond our control, and we cannot assure you that we will meet those covenants.

Adjusted EBITDA is defined as net income (loss) attributable to DJO Finance LLC plus interest expense, net, income tax provision (benefit), and depreciation and amortization, further adjusted for certain non-cash items, non-recurring items and other adjustment items as permitted in calculating covenant compliance and other ratios under our Amended Senior Secured Credit Facility and the Indentures governing our 8.75% second priority senior secured notes, 9.875% senior notes, 7.75% senior notes and our 9.75% senior subordinated notes. We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about the calculation of, and compliance with, certain financial covenants and other ratios in our Amended Senior Secured Credit Facility and the Indentures. Adjusted EBITDA is a material component of these calculations.

Adjusted EBITDA should not be considered as an alternative to net income (loss) or other performance measures presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), or as an alternative to cash flow from operations as a measure of our liquidity. Adjusted EBITDA does not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. In particular, the definition of Adjusted EBITDA under our Amended Senior Secured Credit Facility and the Indentures allows us to add back certain non-cash, extraordinary, unusual or non-recurring charges that are deducted in calculating net income (loss). However, these are expenses that may recur, vary greatly and are difficult to predict. While Adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, Adjusted EBITDA is not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation.

The following table provides reconciliation between net loss and Adjusted EBITDA:

-

Consists of direct acquisition costs and integration expenses related to the Exos, Dr. Comfort, Elastic Therapy, Inc. (ETI) and Circle City acquisitions and costs related to potential acquisitions.

- For the three months ended December 31, 2012, litigation and regulatory costs and settlements includes $2.8 million of estimated costs to complete a post-market surveillance study required by the FDA related to our discontinued metal-on-metal hip implant products, $1.6 million related to ongoing product liability issues related to our discontinued pain pump products, a $1.3 million judgement related to a French litigation matter we intend to appeal and $2.1 million related to other litigation and regulatory costs and settlements.

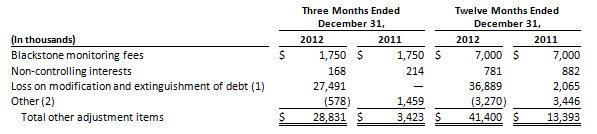

(c) Other adjustment items are comprised of the following:

-

Loss on modification and extinguishment of debt for the three months ending December 31, 2012 consists of $17.2 million in premiums related to the repurchase or redemption of our 10.875% Notes, $12.7 million related to the non-cash write off of unamortized debt issuance costs related to the 10.875% Notes and $0.1 million in legal and other fees, net of $2.5 million related to the non-cash write off of unamortized original issue premium associated with the 10.875% Notes. Loss on modification and extinguishment of debt for the twelve months ending December 31, 2012 consists of the preceding amounts and $8.6 million of arrangement and amendment fees and other fees and expenses incurred in connection with the March 2012 amendment of our Senior Secured Credit Facility and $0.8 million related to the non-cash write off of unamortized debt issuance costs and original issue discount associated with a portion of our term loans which were extinguished. Loss on modification of debt for the twelve months ended December 31, 2011 is comprised of arrangement and lender consent fees associated with the February 2011 amendment of our Senior Secured Credit Facility.

-

Other adjustments consist primarily of net realized and unrealized foreign currency transaction gains and losses.

(d) Other adjustment items applicable for the twelve month period only include future cost savings and pre-acquisition EBITDA related to the acquisitions of Exos, Dr. Comfort, ETI, and Circle City for the year ended December 31, 2012 and Dr. Comfort, ETI, and Circle City for the year ended December 31, 2011.